Entries to Expenses Such as Rent Expense Are Usually

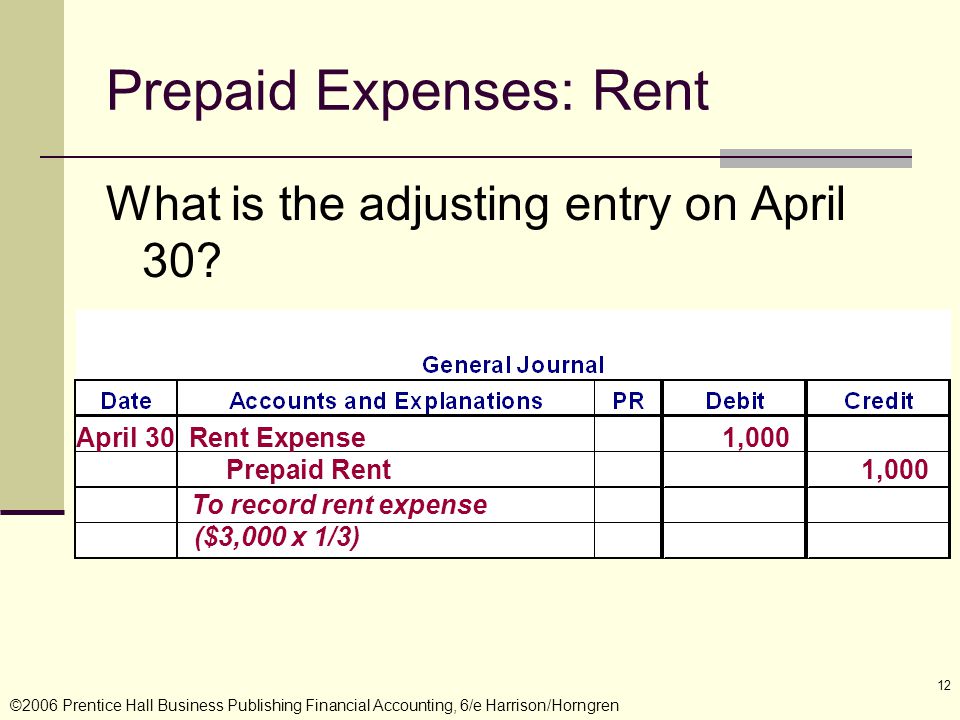

Adjusting entries must be posted to the general ledger accounts. Entries to expenses such as Rent Expense are usually Debits Credits.

Accounting Practices 501 Chapter 8 Balance Day Adjustments Accrued Expenses Prepaid Expenses Cathy Saenger Senior Lecturer Eastern Institute Of Technology Ppt Download

It is useful to note that the provision expense journal entry above should be recorded after.

. Rental income is recorded as revenue and is not dependent on whether you have expenses. Entries to expenses such as Rent Expense are usually. It includes expenses such as rent advertising marketing accounting litigation travel meals management salaries bonuses and more.

Entries to revenues accounts such as Service Revenues are usually. This expense is one of the larger expenses reported by most organizations after the cost of goods sold and compensation expense. DEBIT ASSET ACCT - CASHBANK CREDIT REVENUE ACCT - SERVICE REVENUE ACCRUAL METHOD -.

Entries to expenses such as Rent Expense are usually. These are two separate types of entries. An unadjusted trial balance to which adjusting entries have been added.

Upvote 0 Views 231 Followers 1 Write an Answer. Accounting entries involve a minimum of how many accounts. Entries to expenses such as Rent Expense are usually Debits Credits 2.

Examples of such expenditures include advance payment of rent or insurance purchase of office supplies purchase of an office equipment or any other fixed asset. However as a greater proportion of employees work from home this expense may trend downward over time. On occasion it may also include depreciation expense depending on what its related to.

The journal entry for accrued expenses is straightforward. Rent expense is an account that lists the cost of occupying rental property during a reporting period. In an income statement gross profit.

Entries to revenues accounts such as Service Revenues are usually Debits. What will usually cause the liability account Accounts Payable to increase. Entries to expenses such as Rent Expense are usually.

Budgeting Financial Accounting CMA. Such expenses are relatively small and infrequent and as such. When a company incurs expenses while the payment has not been made the journal entry for such accrued expenses shall be recorded as follow.

The financial statement that reports the revenues and expenses for a period of time such as a year or a. It is part of the adjusting entries in the accounting cycle that each accountant shall be carried out as part of their closing process. Revenue is recorded by creating an invoice sales order or making a deposit.

Entries to revenues accounts such as Service Revenues are usually _____. Bookmark Add Comment Share With Friends Report Explanation No Explanation Available. Journal Entry on Payment of Sundry Expense by CashBank Date Particulars Debit Credit.

These are recorded by debiting an appropriate asset such as prepaid rent prepaid insurance office supplies office equipment etc and crediting cash account. Register now or log in to answer. If a company pays 800 for the current months rent the companys assets and its owners equity will decrease.

Entries to expenses such as Rent Expense are usually A. Only two expenses are usually larger than rental expense. Entries to expenses such as Rent Expense are usually _____.

Cost of goods sold COGS Cost of Goods Sold COGS Cost of Goods Sold COGS measures the direct cost incurred in the production of any goods or services. ANSWER IS CREDIT CASH METHOD - ENTRIES ARE. The listing of all of the accounts available for use in a companys accounting system is known as the.

Entries to revenues accounts such as Service Revenues are usually. Expense Journal entries are the critical accounting entries that reflect the expenditures incurred by the entity. What will usually cause the liability account Accounts Payable to increase.

Prepaid insurance is an. Rental expenses should be recorded as expenses and are not dependent upon whether you have rental income. SGA includes all non-production expenses incurred by a company in any given period.

The party receiving the rent may book a journal entry for rent received. In this case we can record the journal entry of provision expense as below. Payment for rent to the landlord is often.

Usually the amount of general expense is good in quantum. It is typically among the largest expenses that companies report. Debits 1779 students attemted this question.

Entries to revenues accounts such as Service Revenues are usually. Such a cost is treated as an indirect expense and recorded in the books with a journal entry for rent paid. What will usually cause the liability account Accounts Payable to increase.

Salaries Advertisement Cost Raw material Cost. Notes payable is a. Question added by abdelaziz allam محاسب اول شركة كامبردج مصر للاستثمار التعليمي شمم.

One Two Three 12. Accounting entries involve a minimum of how many accounts. Journal entries recorded to update general ledger accounts at he end of a fiscal period.

What is Adjusted Trail Balance. Entries to expenses such as Rent Expense are usually. Journal entries are the base of accounting.

Click To Add Share this question with friends Similar Questions Entries to revenues accounts such as Service Revenues are usually. Rent expense refers to the total cost of using rental property for each reporting period. Journal Entry for Expenses Expenses mean the cost of assets or services enjoyed.

Entries to expenses such as Rent Expense are usually Accounting Debits Credits Answer. Entries to expenses such as Rent Expense are usually.

Accounting Debits Credits Explained Accounting Student Accounting Classes Learn Accounting

Accrual Accounting And The Financial Statements Ppt Download

What Is Debit And Credit An Easy To Understand Explanation Bookkeeping Business Accounting Student Learn Accounting

Comments

Post a Comment